Why can finpx issue a single report?

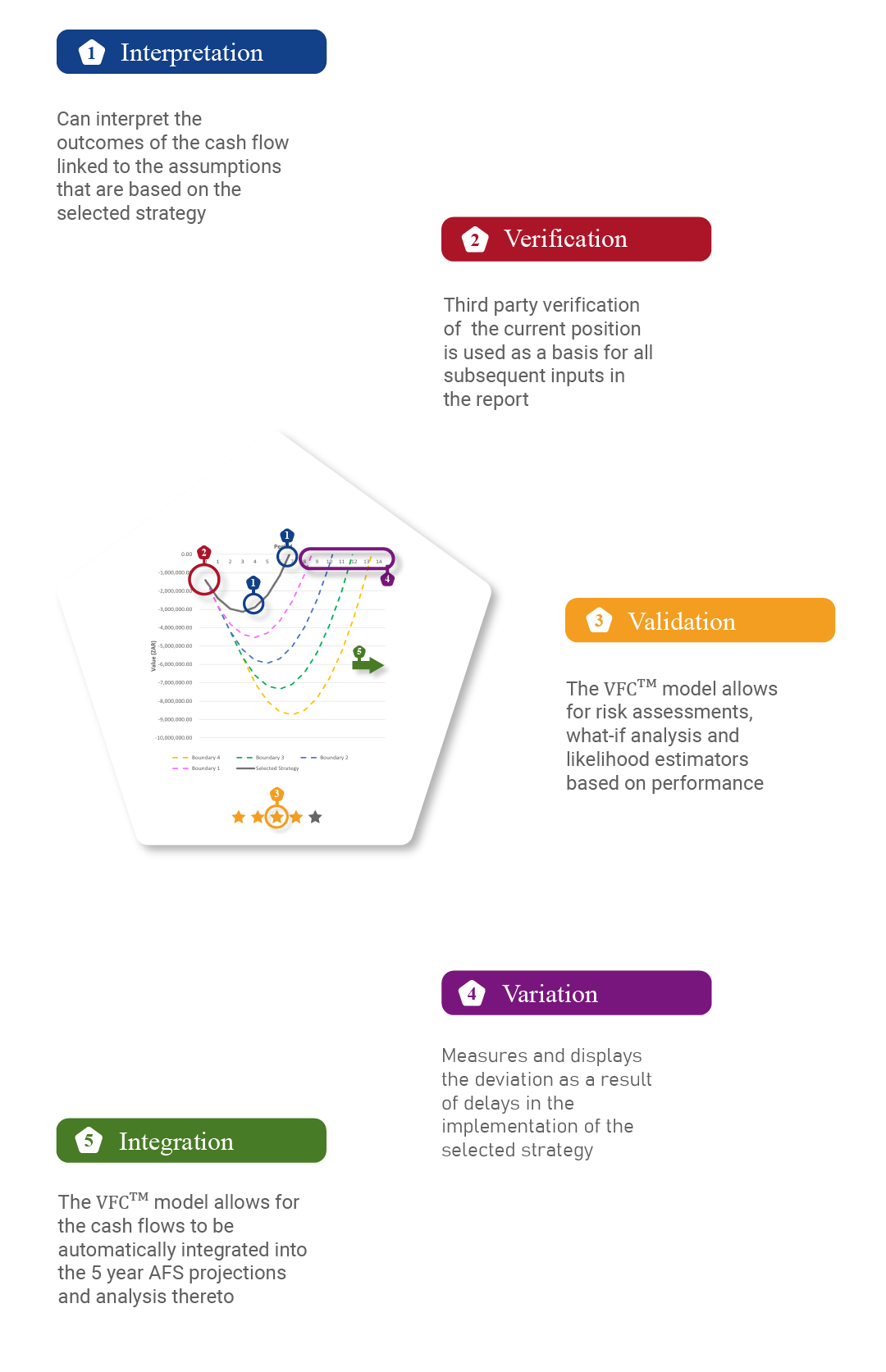

The VFC model is an algebraic method to replace the need for spreadsheets that calculates the cash flow estimates and is the engine that links the

information together.

The VFC is a mathematical model

The VFC model calculates the value of the funding required to implement a selected strategy along with other key points while removing the need for complex error-prone spreadsheets.

The model is able to calculate the cost of a delay in the implementation of the selected strategy and the effect that this delay may have on other key points.

The key points and values referred to as fundamental moments are used in conjunction with the delays to calculate project financial statements for the next five years.

The finpx mathematical model provides the outcomes of the selected strategy in a standardised format. The selected strategy encompasses the intended changes to improve the current financial situation. These changes form the basis of the assumptions made to determine the output values necessary for the fundamental moments.

The VFC model takes into consideration:

- Loss at start

- Abnormal costs (both value and time)

- Incremental changes (both value and time) (planned savings or value of improvements)

- Potential delays

For each scenario, a set of fundamental moments is calculated that answers the following questions:

- Length in periods the firm will take to achieve profitability (duration)

- The point at which breakeven will occur

- The nadir in time (until when funding will be required)

- The size of the funding required (cash flow requirement)